Understanding the Role of Central Banks in Economic Stability

Understanding the Role of Central Banks in Economic Stability

Welcome, readers! Have you ever wondered about the mysterious forces that shape our global economy? Look no further than central banks. These powerful institutions are often shrouded in mystery, but understanding their role is crucial to comprehending the stability of national economies.

In this blog post, we will demystify the world of central banking and explore how these financial powerhouses influence economic stability. So buckle up and get ready for an enlightening journey into the fascinating realm of central banks!

What is a Central Bank?

At its core, a central bank is the backbone of a country's financial system. It serves as the guardian and regulator of monetary policy, with the primary goal of maintaining economic stability. While specific structures may vary from country to country, central banks are typically independent entities that operate under governmental oversight.

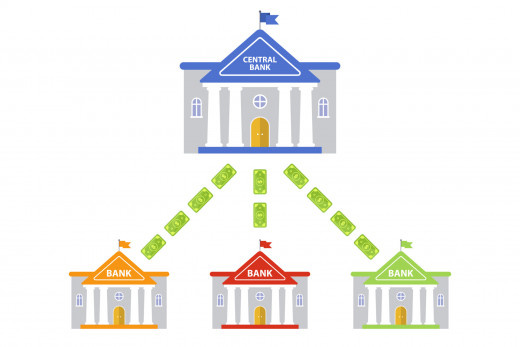

Central banks have multiple responsibilities that revolve around controlling money supply, managing interest rates, and safeguarding the value of national currencies. They act as lenders of last resort for commercial banks during times of financial crisis or liquidity shortages.

Furthermore, central banks also play a crucial role in supervising and regulating financial institutions to ensure their soundness and prevent systemic risks. As key players in the economy's overall health, they work tirelessly behind the scenes to maintain stability through prudent decision-making based on economic forecasts and market trends.

In addition to their regulatory functions, central banks often serve as custodians for a nation's foreign exchange reserves. These reserves are vital assets used to support currency stabilization efforts or facilitate international trade transactions.

Central banks function as pivotal actors in driving economic growth while mitigating potential risks. Through their expertise in monetary policy management and careful monitoring of various economic indicators, they strive to strike a delicate balance between inflation control and promoting sustainable development for their respective nations.

The Purpose of Central Banks

Central banks play a crucial role in maintaining economic stability, but what exactly is their purpose? Simply put, the purpose of central banks is to regulate and control the country's money supply, interest rates, and overall financial system. They act as the backbone of a nation's economy, ensuring its smooth functioning.

One key objective of central banks is to maintain price stability. By controlling inflation and keeping it within acceptable limits, central banks aim to protect the purchasing power of consumers. This helps prevent runaway price increases that can erode people's savings and disrupt economic growth.

Another important purpose of central banks is to promote employment and economic growth. They do this by implementing monetary policies that encourage investment and borrowing for businesses while also supporting consumer spending. By managing interest rates and providing liquidity to financial institutions when needed, central banks help stimulate economic activity.

Moreover, central banks often act as lenders of last resort during times of financial crises or instability. In these situations, they provide emergency funding to commercial banks or other financial institutions facing liquidity problems. This helps maintain confidence in the banking system and prevents widespread panic or bank runs.

Additionally, central banks are responsible for regulating the banking industry to ensure its stability and safeguard against risks such as excessive lending or risky investments. They set capital requirements for financial institutions and enforce regulations aimed at preventing fraudulent activities or market abuses.

The purpose of central banks revolves around promoting stable prices, fostering economic growth with low unemployment levels while also safeguarding the integrity of the financial system through prudent regulation. Their actions have far-reaching effects on individuals' lives through their impact on interest rates charged on loans taken out by households or businesses.

By understanding their purpose better we gain insight into how these influential institutions work towards creating an environment conducive to sustainable economic development

Tools of Central Banks

Central banks play a crucial role in maintaining the stability of an economy. To fulfill this responsibility, central banks have various tools at their disposal. These tools are used to influence key economic factors such as inflation, interest rates, and money supply.

One of the primary tools utilized by central banks is open market operations. This involves buying or selling government securities in the open market to control the amount of money circulating in the economy. By purchasing these securities, central banks inject liquidity into the system, stimulating economic growth. Conversely, selling securities reduces liquidity and helps curb inflationary pressures.

Another tool commonly employed by central banks is adjusting interest rates. By raising or lowering benchmark interest rates, they can regulate borrowing costs for commercial banks and consumers alike. When rates are lowered, it encourages spending and investment which stimulates economic activity; conversely, increasing rates curbs excessive borrowing and helps prevent overheating.

Reserve requirements are also a vital tool used by central banks to manage financial stability. They mandate that commercial banks maintain a certain percentage of customer deposits as reserves with the central bank itself. Altering these reserve requirements allows central banks to control the amount of credit available in an economy.

In times of crisis or liquidity shortages within banking systems, lending facilities provided by central banks become instrumental tools for stabilization purposes. Central bank lending serves as emergency funding for financial institutions facing cash flow difficulties during uncertain periods.

Lastly but not least importantly are forward guidance policies implemented by some modern-day central bankers who use verbal communication as a policy tool to influence expectations surrounding future monetary policy decisions taken on different time horizons from short-term to medium-term perspectives without disclosing explicit detail about those potential actions

Through various means like open market operations,facilitating interbank transactions,lending facilities,and setting reserve requirements among others ,central Banks possess numerous powerful instruments at their disposal.

Expertly employing these tools allows them to navigate economic conditions skillfully while striving towards maintaining price stability,sustainable growth and overall economic stability.

The U.S. Federal Reserve System

The U.S. Federal Reserve System, commonly known as the Fed, plays a crucial role in the economic stability of the United States. Established in 1913, it serves as the central bank of the country and is responsible for carrying out monetary policy.

One of its main functions is to regulate and supervise banks to ensure their safety and soundness. The Fed sets capital requirements for banks and conducts regular examinations to assess their financial health. By doing so, it helps maintain confidence in the banking system and prevents potential crises.

Another tool at the disposal of the Federal Reserve is open market operations. Through buying or selling government securities, it can influence interest rates and control inflationary pressures. This allows them to manage liquidity in financial markets effectively.

The Fed also has powers over reserve requirements, which determine how much money banks must hold against customer deposits. Adjusting these requirements can impact lending capacity and overall economic activity.

In times of crisis or recession, such as during the 2008 financial meltdown, the Federal Reserve acts as a lender of last resort by providing emergency loans to troubled institutions. This helps stabilize markets and prevent widespread panic.

Understanding how this important institution operates gives us insight into how monetary policy decisions are made that affect our daily lives – from interest rates on mortgages to credit card debt levels – all influenced by actions taken by this powerful central bank.

Other Notable Central Banks

Central banks play a crucial role in maintaining economic stability around the world. While the U. S. Federal Reserve System is widely known, there are several other notable central banks that also contribute to global financial stability.

One such central bank is the European Central Bank (ECB), which oversees monetary policy for countries within the Eurozone. The ECB aims to maintain price stability and promote economic growth across its member states through various tools and strategies.

Another prominent central bank is the Bank of Japan (BOJ). With its commitment to achieving price stability and ensuring a stable financial system, the BOJ implements policies like quantitative easing and negative interest rates to stimulate economic growth when necessary.

In Canada, we have the Bank of Canada (BoC) as our central bank. It plays a vital role in controlling inflation, promoting financial stability, and contributing to overall economic well-being by adjusting interest rates and managing monetary policy effectively.

Moving on to Australia, we have the Reserve Bank of Australia (RBA). This central bank monitors domestic and international economic conditions closely while implementing policies aimed at maintaining low inflation levels consistent with sustainable economic growth.

Let's not forget about China's People's Bank of China (PBOC), which operates under a unique set of circumstances due to China's size and influence in global markets. The PBOC focuses on managing currency exchange rates, liquidity conditions, and supporting overall macroeconomic stability within China.

These are just a few examples of notable central banks worldwide; each one has its own unique challenges but collectively work towards fostering stable economies globally. Understanding their individual roles helps us appreciate how these institutions contribute significantly to global financial stability without relying solely on one centralized authority or approach!

The Impact of Central Banks on Economic Stability

Central banks play a crucial role in maintaining economic stability. By using their various tools and policies, they can influence interest rates, manage inflation levels, and ensure the stability of the financial system.

One major impact of central banks on economic stability is through their control over interest rates. By adjusting key interest rates, such as the federal funds rate in the United States or the European Central Bank's main refinancing rate, central banks can stimulate or slow down economic activity. Lowering interest rates encourages borrowing and spending, which can boost consumption and investment. On the other hand, raising interest rates can help curb inflation by making borrowing more expensive.

In addition to managing interest rates, central banks also have tools for regulating liquidity in financial markets. They can provide liquidity to stabilize troubled markets during times of crisis or tighten it to prevent excessive risk-taking that could lead to bubbles or crashes.

Furthermore, central banks serve as lenders of last resort to commercial banks. This means that if a bank faces liquidity problems or runs into trouble due to poor management practices or external shocks like recessions or market panics – they can turn to their respective central bank for emergency funding support.

Central banks are also responsible for regulating and supervising financial institutions within their jurisdiction. This oversight helps maintain confidence in the banking system by ensuring soundness and integrity across institutions.

Central banks have a significant impact on promoting economic stability through their monetary policy decisions and regulatory actions. Their ability to influence interest rates, manage liquidity risks, provide emergency funding support when needed, and oversee financial institutions all contribute towards safeguarding economies from severe fluctuations and promoting sustainable growth.

So next time you hear about central bank actions in your country's news headlines, remember that these institutions play a vital role behind-the-scenes in shaping our economy's overall health!

Comments

Post a Comment